[Report] The Canada Pension Plan’s Evolving Contribution to Retirement Income Adequacy

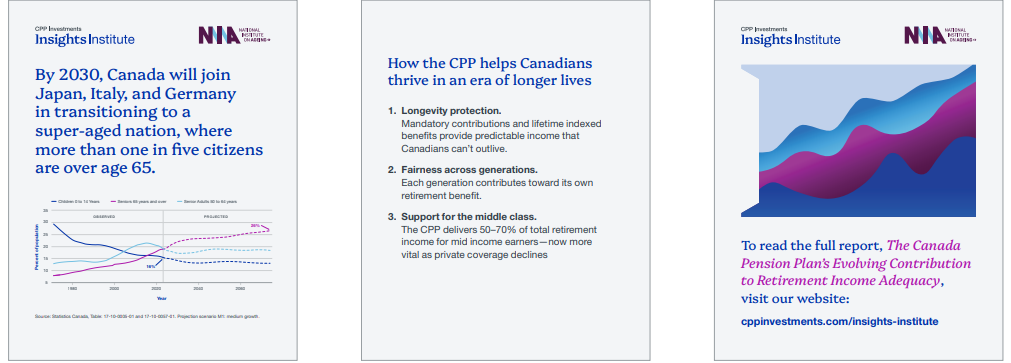

What does it mean to be a super-aged society? For Canada, that question will soon demand an answer. By 2030, Canada will join Japan, Italy and Germany in transitioning to a super-aged nation, where more than one in five citizens are over age 65. It won’t be alone. This same demographic shift is set to play out across advanced economies, reshaping labour markets, fiscal policies and social contracts. In a joint report from CPP Investments Insights Institute and the NIA, the study finds that the Canada Pension Plan (CPP) is well-positioned to support Canadians’ retirement security as the country enters a period of rapid population ageing.

With more than 20% of Canadians soon to be 65 or older, the report finds that the CPP’s design and governance leave it well-equipped to deliver sustainable, fair and lifelong retirement income.

By 2050, nearly nine million Canadians are expected to rely on CPP benefits, reinforcing its role as a cornerstone of retirement security.

Key findings include:

- Built for a super-aged society: Strong design and investment model support resilience as population ageing accelerates.

- Fair across generations: Each cohort pays its share, protecting younger Canadians.

- Lifetime protection: Inflation-indexed benefits act as public longevity insurance, reducing the risk of outliving savings.

Read the full report here

-

Date

Nov 27, 2025

-

By

National Institute on Ageing (NIA)

Newsletter

Sign up for the Healthy Aging CORE Alberta e-news to keep up-to-date with activity from the platform and the Community-Based Seniors Services (CBSS) sector across the province.